13 June 2023

Fleet and Mobility Barometer 2023 report

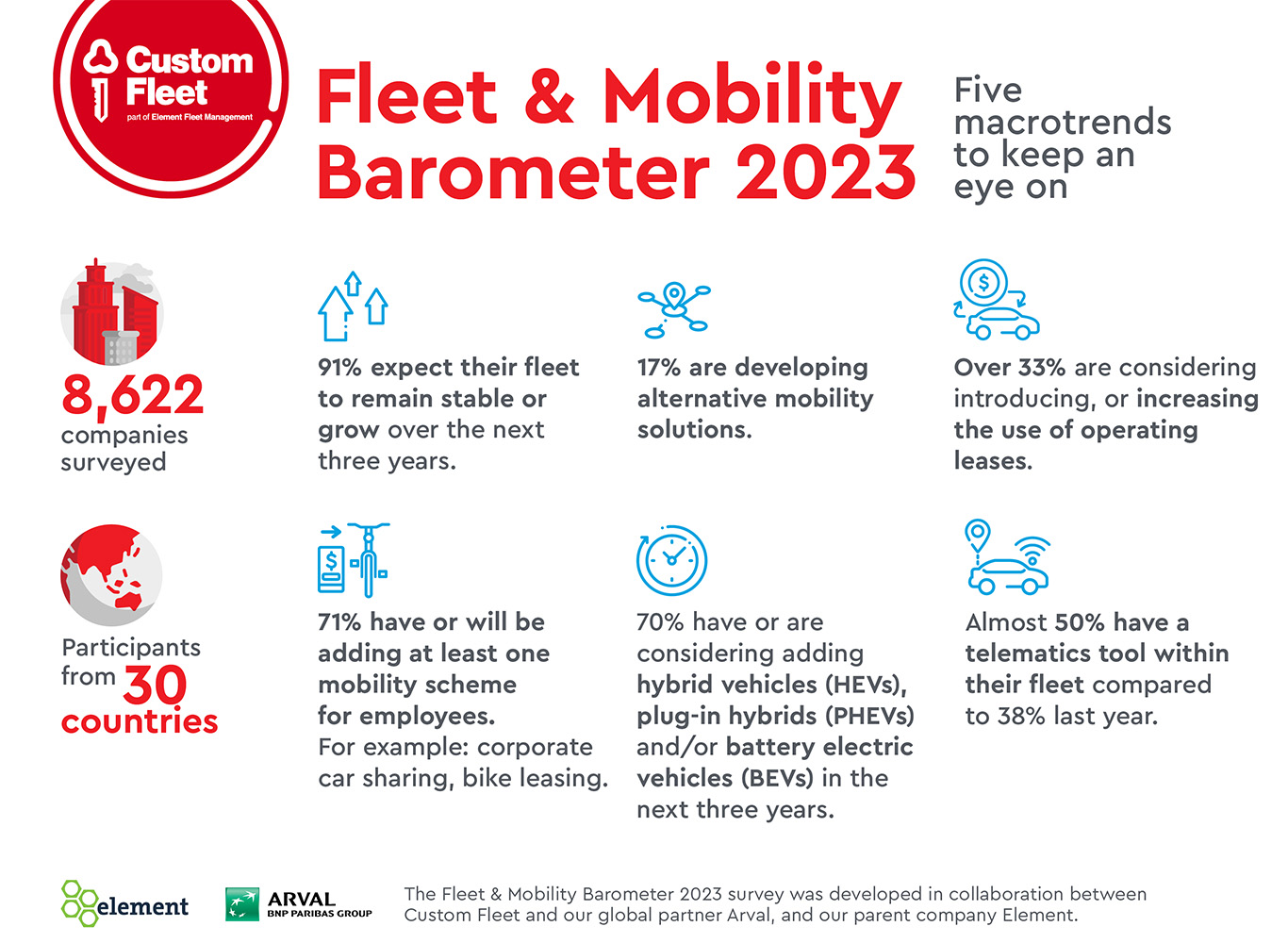

A new global research study forecasting corporate mobility trends has been developed in collaboration between Custom Fleet, our parent company Element, and our global partner, Arval.

Our ‘Fleet Barometer’ study is a great example of how Custom Fleet are working globally to continue to bring value to our customers across ANZ. Fleet electrification is a top priority for many of our customers and this research reinforces the importance of good corporate fleet management and highlights key needs for sustainable mobility solutions. ~ Chris Tulloch, CEO and Country Head ANZ, Custom Fleet

The study is called the Fleet and Mobility Barometer and was conducted over 30 countries across Australia, New Zealand, North and South America, Europe, and Africa.

Interestingly, similar challenges and opportunities around fleets and new mobility solutions follows the same trends globally.

Mobility is an emerging term that refers to more than just fleet management. Mobility includes: car sharing, pool car management, electric charging, fuel, tolls and more.

Despite the current global sentiment of uncertainty, results show that companies intend to pursue the growth of their fleet, focusing on energy transition, connectivity, and new mobility solutions.

The Fleet and Mobility Barometer forecasts five key macro trends for the foreseeable future:

- Company fleet size to continue to grow or remain stable

- Full service leasing financing method to continue to grow across countries

- Energy transition is accelerating

- Mobility solutions are increasingly being implemented as an add-on to company cars

- Connected services continue to increase

- Company fleet size will continue to grow or remain stable

- Full-service leasing financing method to continue to grow countries in all business types and sizes

- Energy transition is accelerating

- Mobility solutions are increasingly being implemented as an add-on to company cars

- Real acceleration in the implementation of connectivity with an increase of 10 points compared to last year.

Of all the companies surveyed, 91% expect their fleet to remain stable or grow over the next three years (27 % anticipate an increase and 64 % anticipate a stable fleet).

In some instances, the sharp increase is related to HR considerations. Retaining and attracting talent has become a key challenge for many companies globally (39%).

The impact of working from home is limited and among the companies that have changed or are considering changing their mobility policy, 17% are developing alternative mobility solutions.

The most important challenges anticipated by fleet decision makers are the transition to alternative fuel technologies and adaptation to restrictive public policies on internal combustion engine vehicles.

More than one third of the companies interviewed are considering introducing, or further increasing the use of operating lease in their financing and fleet management model in the next three years. The increase in full-service leasing remains in-line with the levels observed prior to Covid-19.

This has been identified in all types and sizes of businesses: 34 % of the smallest intend to introduce or increase the use of full-service leasing in their fleets, a proportion that is getting relatively close to the levels observed in mid-size and large companies for a number of years.

Across all countries and companies surveyed, 70% have already implemented or are considering implementing at least one of the following alternative technologies on their PC fleet, within the next three years: hybrid vehicles (HEVs), plug-in hybrids (PHEVs) and battery electric vehicles (BEVs).

The trend is the same whatever the size of the company. This energy transition is on-going in all countries.

84% of surveyed companies are already informed about mobility solutions and 71% of companies have already implemented at least one mobility scheme for their employees (corporate car sharing, bike leasing or a mobility budget are a few of them). Most of the 88% surveyed have already implemented or intend to invest in such mobility schemes over the next 3 years.

When it comes to broader mobility solutions, the most implemented solutions are bike sharing/bike leasing (15 %), short or mid-term rental (18 %) and ride sharing (19 %), with these solutions often seen as an add-on to the company fleet, the likelihood to give up all or part of the fleet for mobility solutions remaining pretty low.

Almost one of two companies have a telematics tool within their fleet compared to 38% last year. The main reasons to have connected vehicles are to locate vehicles, improve vehicle security (41%), improve driver safety (34%), improve operational efficiency (29%) and to reduce fleet costs (25%).

Methodology

For this independent survey, 8,622 companies decisions makers interviews were carried out between 18 August 2022 and 11 November 2022 for 25 countries and between the 9 January 2023 and 30th of March 2023 for North America, New Zealand, Australia and Mexico by an independent research company Ipsos. Participants were recruited by telephone with a full interview conducted by phone. Countries include: Austria, Deutschland, Belgium, Spain, France, Greece, Italy, Luxemburg, the Netherlands, Poland, Portugal, UK, Czech Republic, Slovakia, Romania, Switzerland, Finland, Denmark, Norway, Sweden, New Zealand, Australia, Mexico, North America, plus the fleet markets of Turkey, Morocco, Chile, Peru and Brazil. The companies in scope operated at least one vehicle.